On July 1, 2021, new tax rules were introduced in the EU countries. All purchases on AliExpress are subject to VAT. Even if the product costs €1. But we, the buyers, will not be greatly affected by the new rules. Purchases up to €150 will arrive as before. And if the product costs more than €150, you need to ask the seller who pays VAT. The only inconvenience is that prices will rise slightly.

Sale on AliExpress without taxes and customs

Permanent sale. Goods from local warehouses. Fast delivery, no additional taxes and fees

What has changed in the rules for paying VAT in the European Union since July 1

Previously, goods valued less than €22 were not subject to VAT. That is, if you bought jeans on AliExpress for €15, then you paid €15. This gave an advantage to companies importing goods to Europe.

On July 1, 2021,came into force new EU tax rules. Now everyone pays VAT on imports on the same terms.

How the VAT on AliExpress will affect my purchases

- Some items that used to cost less than €22 will become more expensive. The price will rise by €1-2.

- Most of the goods will not rise in price. Vendors have paid VAT in the EU before.

- If you buy a product that costs less than €150, then the buying process will not change. Everything will be the same as before.

- And if a unit of goods costs more than €150, then you will need to issue VAT on AliExpress. Most often, the seller himself does this. But sometimes you have to fill out the declaration in person.

- If you are a VAT payer, you can get an Invoice and get a tax refund.

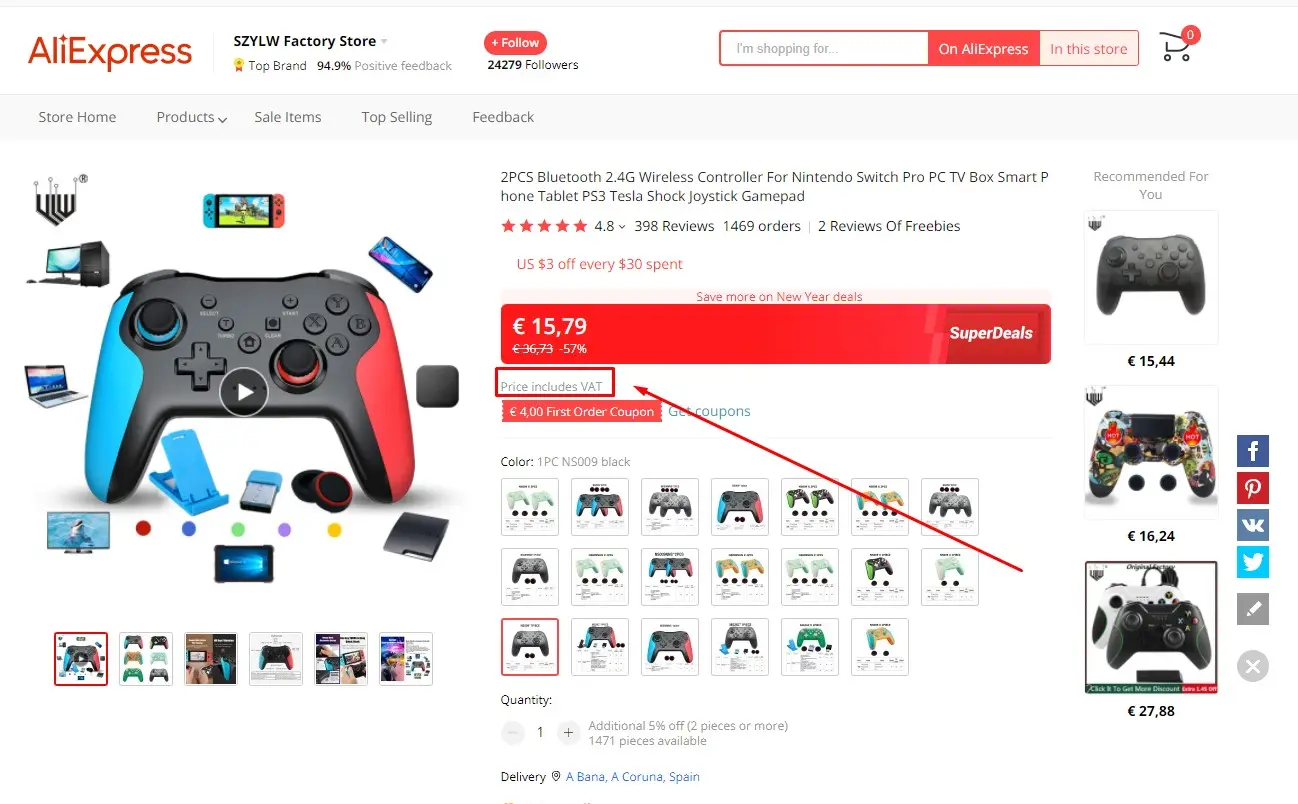

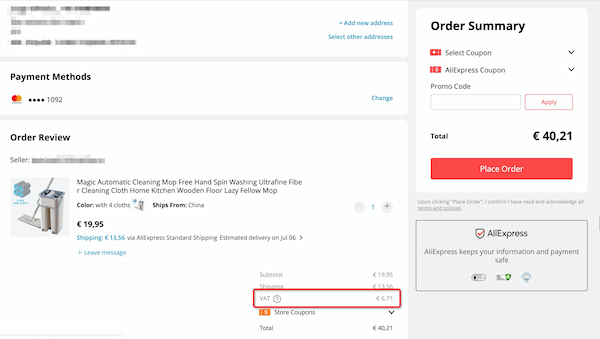

The VAT amount on AliExpress will only be shown when you pay for the item. That is, in the product card you will see the price excluding VAT. And only when you complete your purchase and proceed to payment, tax will be added to the amount.

Official information about VAT on AliExpress.

AliExpress VAT invoice

Tax is payable according to EU rules. You can get an AliExpress VAT invoice for all purchases. To do this, you need to go to your profile on the site. Then follow the path Orders / All Orders / Download Invoice.

You can print these documents and submit them to your tax authorities. They are legally binding. And if you have the right to do so, then VAT will be returned to you.

AliExpress VAT invoice for business buyers

Businessmen can receive an invoice from AliExpress, in which their VAT data will be entered. To do this, you need to:

- Go to MyAliExpress.

- In the column on the right, select the Buyer Tax Information Collections menu item.

- Enter your information.

- The information will be saved, and you can then automatically generate an AliExpress VAT invoice with your VAT data.

- This feature is currently only available for the European Union and the United Kingdom.

Possible problems and solutions

Problems arise if the seller sends you a parcel from China other than AliExpress standard shipping. Other errors are possible. The carrier doesn’t know that this package is going from AliExpress. Therefore, it requires you to carry out customs clearance and pay VAT.

To avoid problems, please ask the seller to include the IOSS AliExpress number on the package.

How much is VAT on AliExpress

Each country of the European Union independently sets the VAT rate. The average rate in Europe is 21%. VAT on AliExpress is charged depending on which country the package is sent to. Remember this when filling out your shipping address.

According to the Tax Foundation, the following VAT rates are currently in effect in the EU:

| Country | Super-reduced VAT Rate (%) | Reduced VAT Rate (%) | Parking VAT Rate (%) | Standard VAT Rate (%) |

| Austria (AT) | – | 10/13 | 13 | 20 |

| Belgium (BE) | – | 6/12 | 21 | December |

| Bulgaria (BG) | – | 9 | – | 20 |

| Croatia (HR) | – | 5/13 | – | 25 |

| Cyprus (CY) | – | 5/9 | – | 19 |

| Czech Republic (CZ) | – | 10/15 | – | 21 |

| Denmark ( DK) | – | – | – | 25 |

| Estonia (EE) | – | 9 | – | 20 |

| Finland (FI) | – | 10/14 | – | 24 |

| France (FR) | 2.1 | 5.5 / 10 | – | 20 |

| Germany (DE) | – | 7 | – | 19 |

| Greece (GR) | – | 6/13 | – | 24 |

| Hungary (HU) | – | 5/18 | – | 27 |

| Ireland (IE) * | 4.8 | 9 / 13.5 | 13.5 | 21 |

| Italy (IT) | May | 4/ 10 | – | 22 |

| Latvia (LV) | – | 5/12 | – | 21 |

| Lithuania (LT) | – | 5 / 9 | – | 21 |

| Luxembourg (LU) | 3 | 8 | 14 | 17 |

| Malta (MT) | – | 5/7 | – | 18 |

| Netherlands (NL) | – | 9 | – | 21 |

| Poland (PL) | – | 5/8 | – | 23 |

| Portugal (PT) | – | 6/13 | 13 | 23 |

| Romania (RO) | – | 5/9 | – | 19, |

| Slovakia (SK) | – | 10 | – | 20 |

| Slovenia (SI) | – | 5 / 9.5 | – | 22 |

| Spain (ES) | 10 | April | – | 21 |

| Sweden (SE) | – | 6/12 | – | 25 |

| United Kingdom (GB) | – | 5 | – | 20 |

As you can see on the map, tax rates are very different.

Ordering goods to another country is a legal opportunity to reduce VAT on purchases.

VAT on AliExpress in the UK

Although the UK has left the EU, it has implemented the same tax reform. The European Union has postponed the introduction of the new rules until July 1. And the UK introduced them on January 1, 2021.

Therefore, the UK already has VAT regulations on AliExpress. The VAT rate in the UK is 20%.

How is VAT paid on AliExpress for purchases under €150

You do not need to do anything. Registration of documents and payment of taxes will be done by AliExpress. The only inconvenience is the increase in the price of goods that previously cost less than €22. All other goods were subject to VAT before. Therefore, you have already bought products that have tax included in their price.

If you want to return VAT later, you just need to print the documents. And submit them to the tax authorities.

Customs, tax authorities, carriers and logistics companies should not re-charge your VAT on purchases under €150.

On July 1, a new VAT registration procedure began to operate – IOSS (Import One Stop Shop). This allows platforms like Aliexpress to customize the design themselves. It is convenient for buyers – they do not need to fill out any documents.

How VAT is paid on AliExpress for purchases over €150

In this situation, two options are possible:

- You buy a product that is already in a warehouse in the European Union. Then you don’t have to do anything. The seller has already paid VAT and included it in the price.

- You are buying a product that is outside the European Union. Then you need to contact the seller and ask him what the VAT payment procedure will look like.

Purchases over €150 from a warehouse in the European Union

It is made in the same way as any other purchases in the EU. As at the checkout in the nearest supermarket, you make a payment and receive the goods. The price already includes VAT. If necessary, you can get an AliExpress VAT invoice.

Please make sure the item will ship to you from the EU before purchasing. When looking for goods, select “Delivery from….” In the search menu.

Purchases more expensive than €150 from a warehouse outside the European Union

In this situation, 2 options are possible:

- All actions for VAT registration are undertaken by the seller. In this case, you only pay money.

- You must register VAT yourself. In this case, the carrier will contact you when the parcel arrives in the country.

The VAT clearance process depends on which carrier is delivering the goods to you. Check with the seller for delivery details.

Customs fee and other taxes for purchases on AliExpress

Please note – even if you have already paid VAT, you may still have to pay customs duties and other taxes. This is rare. But in some countries, certain groups of goods need to be cleared at customs.

Of course, this has nothing to do with goods that AliExpress has already delivered to warehouses in the European Union. They have already passed customs clearance, all taxes and fees have been paid. You are making a purchase in the EU.

What happens to orders made before July 1

According to European law, all orders made before July 1 will not be subject to VAT. But you may have to pay the carrier for customs clearance costs. This is a small amount for the logistics company to fill out the declaration.

Will there be a VAT refund when returning the goods

There are two options:

- If AliExpress was involved in VAT registration. Then, when you return the goods, you will be refunded the entire amount paid. Including – VAT will be refunded.

- If the seller was involved in VAT registration. Then you need to negotiate with the seller.

Please note – VAT and other administrative expenses will not be reimbursed in any case. But don’t worry, these are always small amounts.